These countries are among the biggest gold consumers

In Rome, Julius Caesar gifted 200 gold coins to each of his soldiers to celebrate their victory against Gaul. Gold production and consumption have grown continually through modern times. In fact, most gold worldwide—more than 90%—has been mined since the mid-1800s California Gold Rush.

Today, gold is used broadly across industries from dentistry to electronics, where its durability and conductivity make it well suited for wiring and plating. Individuals worldwide also continue to invest in gold, collecting it in various forms: from bars and coins to jewelry. According to World Gold Council data, buyers purchased more than 3,200 metric tonnes of gold in 2023, and the average price per ounce set a new record: $1,940.54, an 8% increase from the previous year.

SD Bullion used data from the World Gold Council to break down gold consumption per capita, identifying the countries with the greatest consumer demand. Keep reading to learn more about how this demand has changed in recent years and the different ways people invest in this precious metal.

SD Bullion

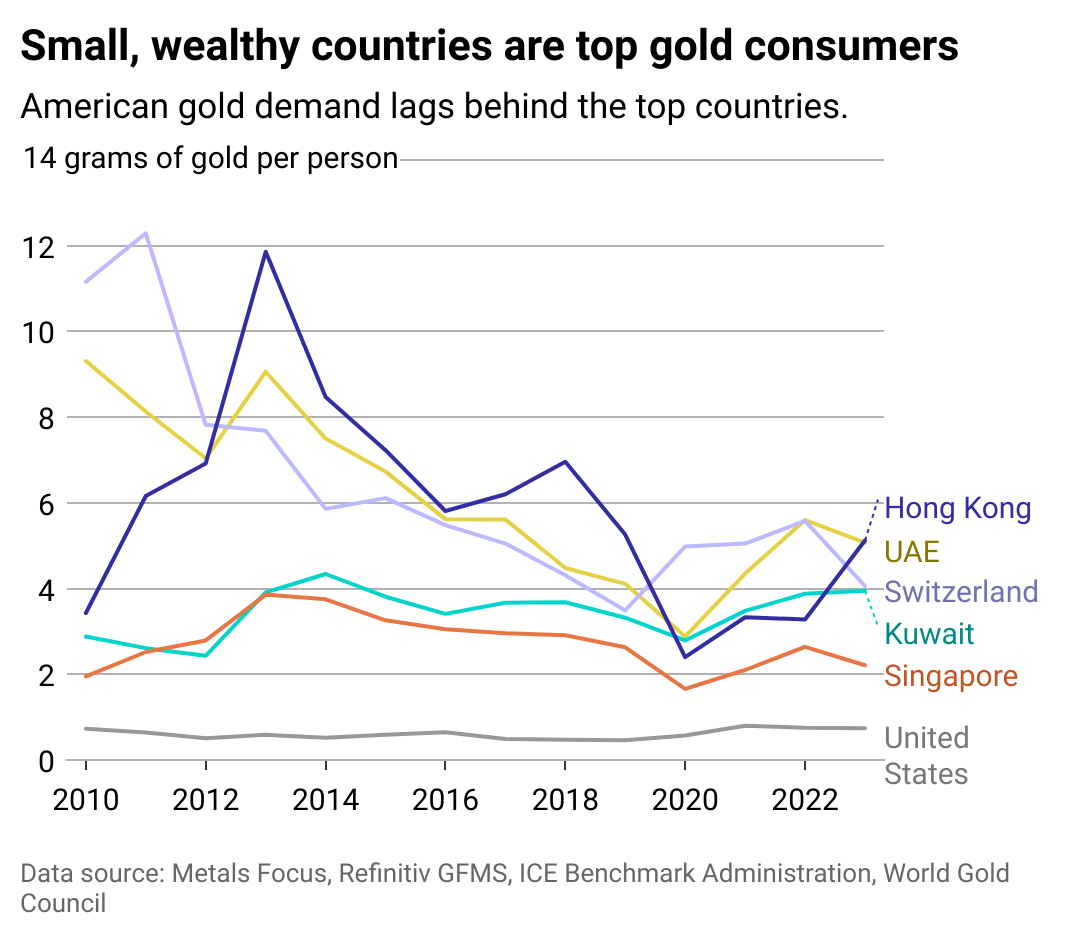

Consumer demand has fallen over the past decade

Consumer demand for gold has declined globally for the past decade, so U.S. consumption ranks well below smaller, wealthier countries like the United Arab Emirates, Switzerland, and Kuwait. Rising gold prices and economic change—including significant cost of living increases—have impacted both the jewelry market and consumer investments internationally in bars and coins. Central banks, however, kept a "historic pace" in 2023, continuing to build their reserves by purchasing large amounts of gold.

While overall demand is reduced, gold remains a popular investment in many countries where unique regional factors contribute to greater interest. In China, for example, buyers are investing in gold at younger ages than ever before. Trends favoring traditional Chinese elements in jewelry contributed to a 16% increase in gold consumption in the first half of 2023. Comparatively, investors from the UAE preferred buying gold bars and coins in 2023. Viewing these purchases as stable investments that would yield better returns, demand for the year equaled 11 tonnes—a 34% increase from 2022.

SD Bullion

How people buy gold

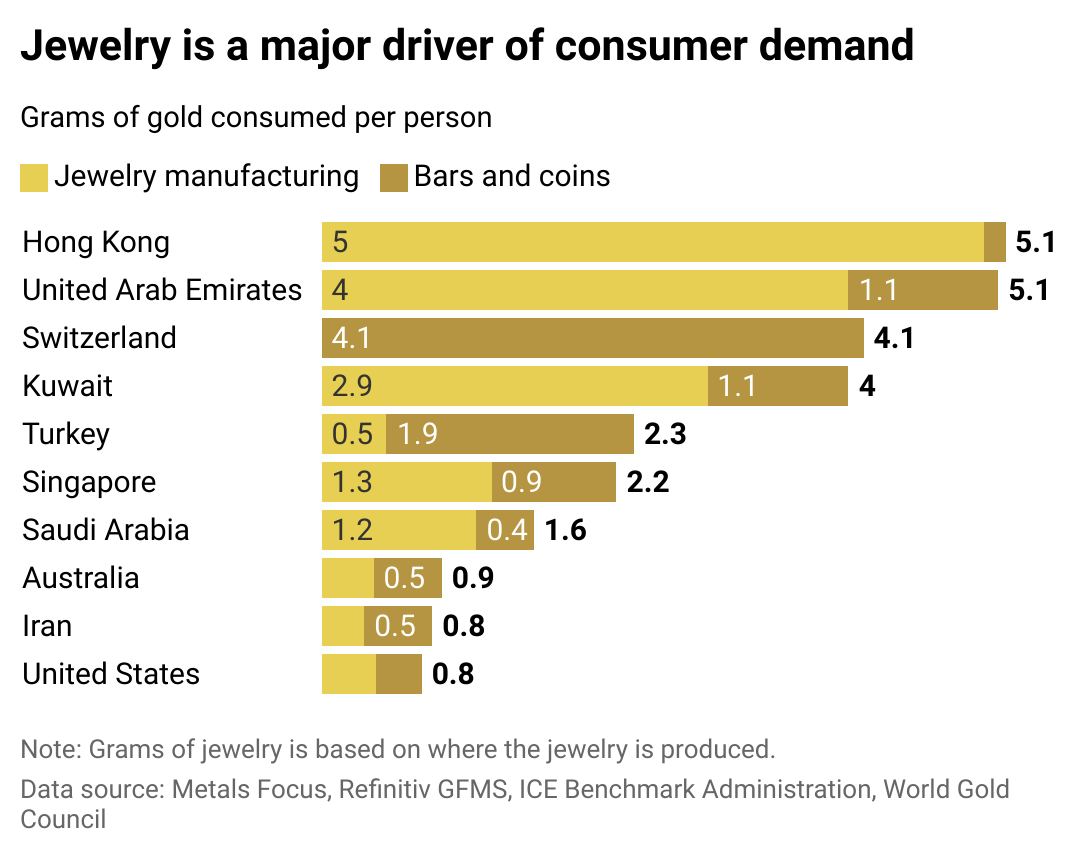

Jewelry is more than just an expression of style or a status symbol, it is the most popular form of gold for investors in countries around the globe. Many younger people in China choose to purchase gold because of its stable, long-lasting value rather than attempt fluctuating investments in stocks or real estate.

In 2021, World Gold Council data showed that 3 in 4 buyers were between 25 and 35. However, in other countries like Switzerland—one of the world's biggest gold importers and refiners—buyers invest in more bars and coins than jewelry.

Where do people store these investments? Privately owned vaults are a popular option for those with a great deal of wealth to protect. Providing safe storage outside of banks—which many fear could be difficult to access, or collapse, in an economic crisis—these vaults are typically located in politically stable countries like Switzerland and Singapore. Those who own a smaller amount of gold, however, may simply invest in a home safe to store and protect their gold—in any form.

Story editing by Elsie Drexler. Copy editing by Paris Close. Photo selection by Clarese Moller.

This story originally appeared on SD Bullion and was produced and

distributed in partnership with Stacker Studio.

More Articles to Read